After a meeting where the township blindly took on another long term financial obligation to maintain a storm water basin with zero accounting of the real dollar costs…It’s clear the township needs to bring in a professional consultant who does lifecycle value per acre evaluation if we cannot do it consistently in house. We have to make officials responsible for choices they make by demonstrating clearly long term impact. My friend and former Commissioner Deana Zosky was the first and only person who talked about this kind of stuff in Lower Mac. Economic growth should build on a foundation of understanding the tax implications of differing choices. We do not have that foundation today and it was on full display last Thursday.

Think about this for a second:

An average single family home in a subdivision in Lower Mac:

(used an average assessed house on wheatland dr. as example)

Square feet: 2,128

Assessment calculated at: $256,700

This means the homeowner pays about 120 dollars in assessed value per SF

Example of an existing warehouse in the township:

Square feet: 1,000,000

Assessment calculated at: $24,100,000

This equals 24 dollars in assessment per SF

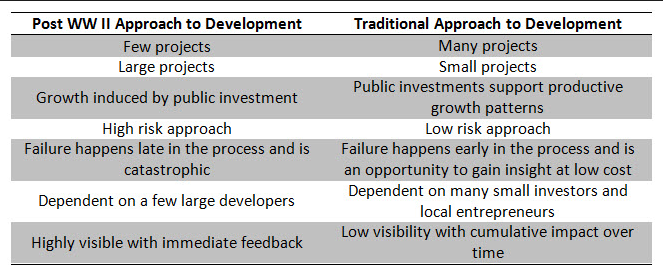

So basically, a residential homeowner is paying 6X the tax liability per square ft vs. a warehouse. This is insane. A residential single family home maybe generates 4-6 car trips a day. Sits on maybe an acre of land. Compare to warehouses that generate massive public liabilities, create mind boggling amounts of traffic, huge amounts of storm water discharge, require super-sized – and massively expensive road improvements – and most disturbing each million plus warehouse churns up 60 acres of land. In Lower Mac’s case prime farmland. All while generating extremely low jobs and revenue per acre vs. other more community friendly neighborhood commercial uses.

The problem is an assessment calculation system that heavily weights market value as a determining factor. Market value has little to nothing to do with impact. Why should a homeowner be punished for adding a deck? Does that somehow increase the amount of traffic your home generates? The amount of stormwater? The kids you have in the district?

When you dig into this it’s maddening. It is a totally broken and backwards system where the highest liability land uses pay the least amount in taxes apples to apples in relation to the impacts they create. Road wear and tear. Stormwater run-off. Public responsibility to maintain infrastructure. Muni services. Again, this is top of mind since we just blindly took on a new storm water basin with ZERO information about long term costs. A stormwater basin that would have never existed in the first place had the township been able to maintain it’s growth boundaries of the 80’s. Now that we have it I’m interested in how we pay for it. That’s what this conversation is all about. What land uses shoulder the burden.

As I always ask: Whose subsidizing who?

It’s not just about fundamental in-balance. Again, in the current system if you take a dilapidated building and fix it up. Or start a business and consider converting to commercial. What happens? You get punished for it tax wise. But the greenfield developer who gobbles up huge amounts of land, requires new public infrastructure, creates very low jobs/acre and revenue/acre vs. other other massive liabilities. They get rewarded.

RELATED: Gaming the system makes it worse – Big Box stores ringing up property tax discounts.

There are very real underlying financial issues where the deck is stacked in favor of greenfield development and other stealth subsidies that drive sprawl. The way we calculate assessments is one aspect. We need to calculate assessment based on land + Impact. Not buildings or building improvements or building quality.

We start by eliminating and rolling back arbitrary regulations that actually prevent, outright outlaw and deter more productive and higher value development.

We start by eliminating and rolling back arbitrary regulations that actually prevent, outright outlaw and deter more productive and higher value development.