At least not entirely at least. Not even close.

Liquid fuel money is a state allocation of gas tax distributed to municipalities based on a funding formula. Lower Mac’s most recent act 655 liquid fuel allocation was 785,000 (based on 131 miles of road, population of 30,633)

*We carry an additional balance year to year in this fund because the state limits very specifically what this money can be used for.

So, what does it cost to maintain 131 miles of roads?

Rough breakdown:

Salaries 1 crew chief and 8 crew members and 2 PT: 700,000

Road resurfacing: 450,000

Other general: (emergency repairs, fuel, equip repair and rental) 300,000

Winter Maintenance: 176,000

Traffic control devices: (includes repairs, electricity, new systems) 100,000

Roads & Bridges line item: (includes crack sealing, line striping, milling etc) 750,000

Capital: (includes intersections, capital bridge repair and equipment) 700,000

Total costs: 3.1M

That is 24,244 dollars a year to maintain the road network per mile of road.

*Some of these costs include new systems so it’s not a true representation of the cost to maintain existing. It accounts for growth. Even with zero additional roads (not the case, we are assuming and building more each year) these costs will rise each year.

**Now also understand that some of these costs are also paid for by other programs state or local instead of general or capital revenue streams. For example we have some traffic impact fee money banked. What I want is the THE number of the year to year township liability for each mile of new road. It may be higher or lower than I am sketching here.

Add to this on the 5 year capital plan we have 3.3 Million dollars in road related items including the Sauerkraut extension.

Over the next year I want to understand this better. One of my goals. And hopefully and project of the budget and finance committee. To truly understand the costs of new development and building new roads / assuming new road maintenance liabilities we have to understand these numbers. Above is very rudimentary and an exercise in progress.

UPDATE:

I asked my friend Rob Sentner who is a Supervisor in Upper Milford if they ever tried to quantify cost/mile/year. He answered with some excellent thoughts..

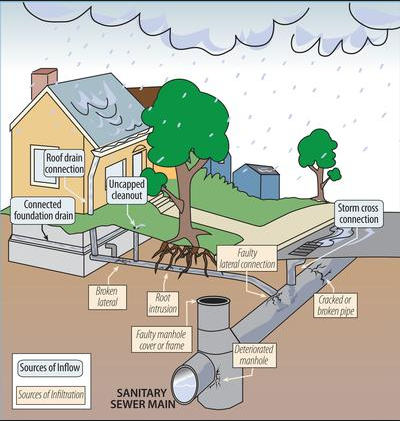

“Problem is we have all deferred repairs, tar and chipping is a band aid, nova chipping is a better alternative, the big thing that I think is missing is that some of the older non modern roads do not have the base to handle the weight capacities that they are being subjected to. (DUE TO INCREASED AND UNPLANNED FOR FREIGHT) Also a lot of the cross pipes are of corrugated steel and because of the liquid calcium and the ridiculous amount of salt that we now put on our roadways, the bottoms are failing. Try getting a DEP permit to replace a pipe……. so short answer Ron is I don’t know how you come up with an accurate number other than normal maintenance crack sealing, coating and plowing. I think the entire area is in for a eye opening cost to modernize our roadways to the kind of traffic and weight we are going to see. PennDOT seems to be having trouble keeping up to simple maintenance let alone trying to improve and enhance our roadways. add in the MS4 requirements coming our way you can forget about swale cleaning or any kind of discharging water to waters of the commonwealth.”