Author Archives: admin

2020 Community Survey Results

Over 900 township residents took this poll in the Spring of 2020. I created it so residents can give Commissioners feedback on our community. It included general and specific issues as well as guidance on what we should focus on in 2020 and beyond.

The survey used an established and reputable survey app. Residents had to provide a valid email and the polling app only allowed 1 vote person. (Note, some questions have fewer responses because questions were able to be skipped.)

Poll was open to Lower Mac residents ONLY. Here were the results:

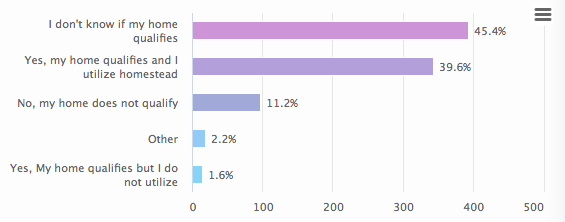

1.) Lower Macungie has very low residential property taxes. The rate is among the lowest in the state for a suburban community our size. Part of how property taxes are kept so low in Lower Mac is our use of a homestead exclusion.

Do you know if you qualify for the homestead exclusion to reduce your township property tax bill?

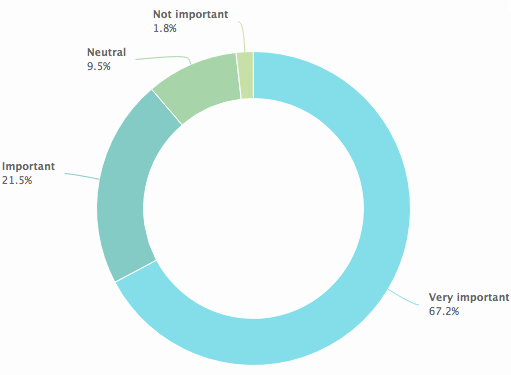

2.) How important is it to keep the homestead reduction in place as a way to ensure township property taxes remain low while ensuring impactful commercial entities (like existing warehouses and shopping centers) pay a fair share?

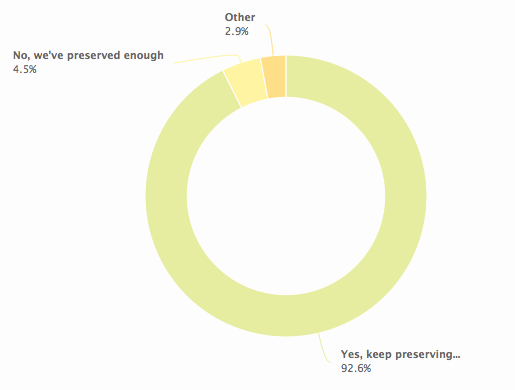

3.) Through various strategies, Lower Macungie has successfully and permanently preserved over 500-acres of farmland and open space last 5-years. This includes the 190-acre Weiner Farm located adjacent to Sauerkraut Ln, Brookside Rd and Macungie Rd. This is the largest preservation effort of its kind in Lehigh Valley history. The property was under immediate threat of being developed with over 250+ homes if action wasn’t taken.

Should the Township continue preservation efforts?

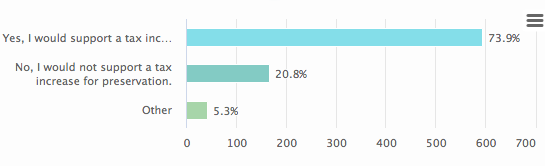

4.) If you chose YES to the previous question and believe Lower Macungie should continue preservation efforts:

If another major preservation effort was identified BUT would require a small tax increase AND if it would include a sunset provision so the tax automatically repealed after a specific goal is completed, would you support a targeted tax via referendum for the specific purpose of farmland or open space preservation?

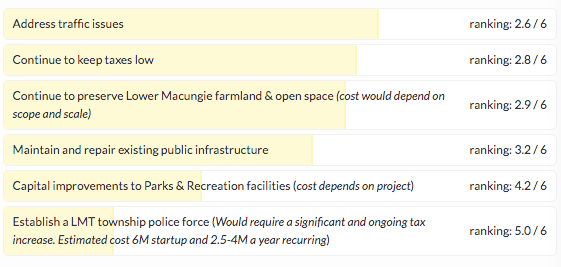

5.) Rank these possible Lower Mac initiatives in order of importance. (1 was highest priority, 6 was lowest priority)

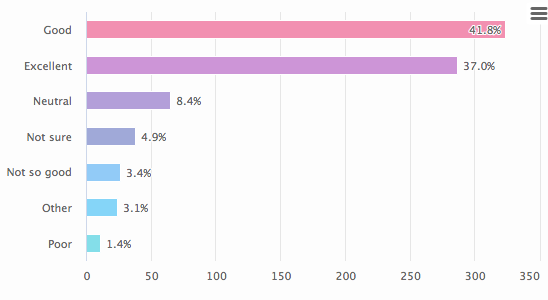

6.) Lower Macungie gets our local police protection from the Pennsylvania State Police. Are you happy with the service Pennsylvania State Troopers provide to our community?

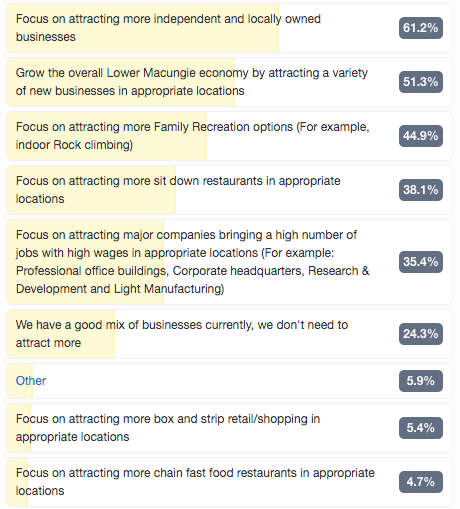

7.) A goal is to better market Lower Macungie as it’s own economic entity and unique place to live, work and play. In terms of economic development (*in appropriate locations) what should we focus on for our community as part of these efforts? Check all boxes you agree with. Leave blank ones you do not.

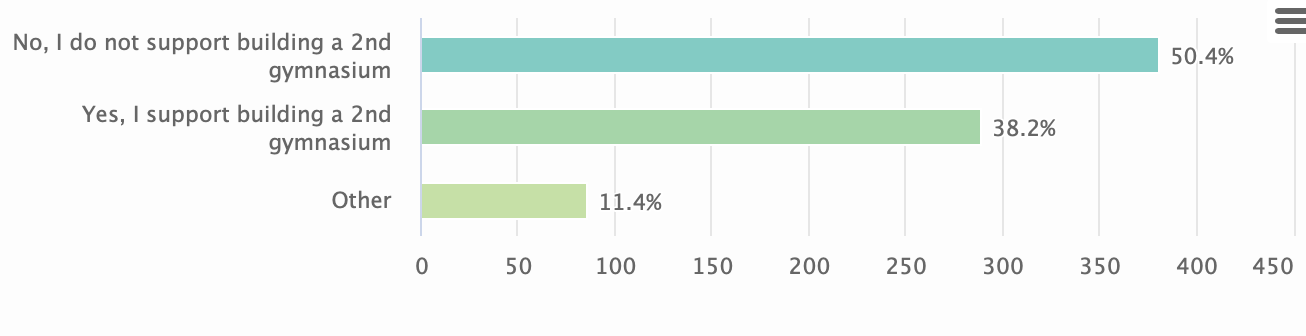

8.) An ongoing project, Lower Macungie Township has spent several million dollars expanding the community center with an additional gym and more community room space. This was paid for primarily through use of a line of credit.

Do you support this?

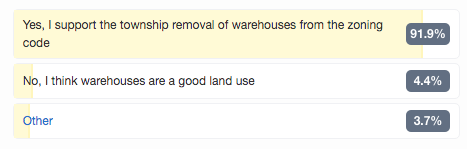

9.) In 2017 Lower Macungie Commissioners made new warehouses illegal in most all Township areas. This includes Industrial and Light Industrial districts where they were previously allowed. No new warehouse applications can be submitted in these areas.

Do you support the townships removal of warehouses from the zoning code?

10.) Over the last few years, Lower Macungie Commissioners denied several controversial land development applications that the Board of Commissioners felt were too impactful for the neighborhoods proposed. In some cases, the Township was sued and had to defend its decision.

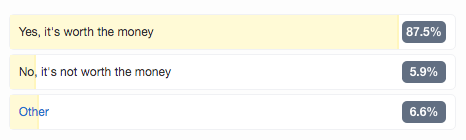

Is it worthwhile for the township to spend public dollars defending decisions to deny certain impactful land development applications?

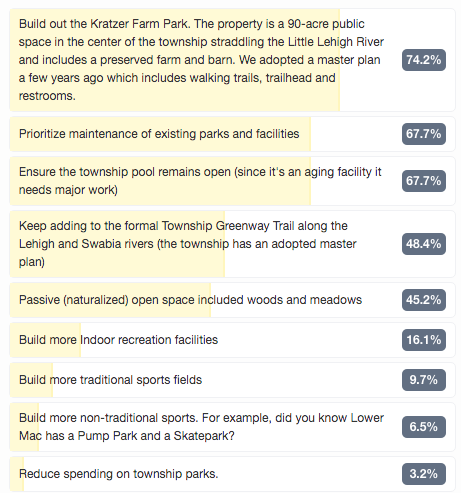

11.) Lower Macungie has a 1400+ acre park system. What are your priorities for the park system? Choose your top priorities. Leave blank items you do not feel should be a priority.

The choices were (since some were long and cut off on the graph below)

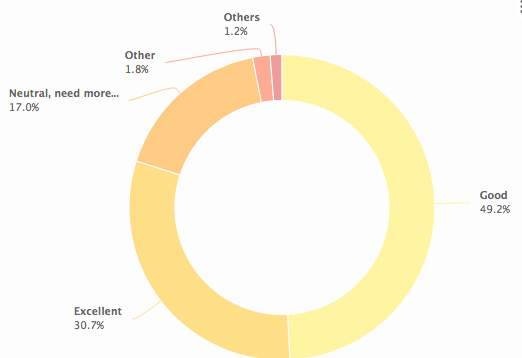

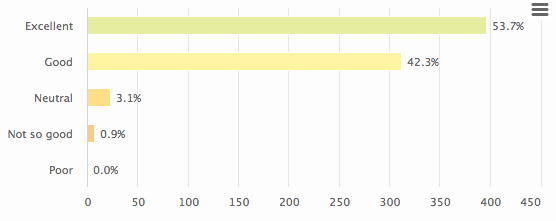

10.) Overall, how would you categorize Lower Macungie as a place to live?

11.) Are Lower Macungie Commissioners doing a good job? Do you feel like you are being represented well?

Resolution to revoke Gov. emergency order passed. What does it mean?

Trying to understand how last nights vote in the state legislature impacts the shutdown immediately and why the upcoming legal fight concerns constitutional checks & balances. There is a ton of conflicting information to wade through. I hope this helps. I always try to present info on this blog and social media without political theatrics.

As we all now know, last night the State Senate and House passed a resolution to terminate the emergency Gov. Tom Wolf issued in March. (This probably should have been done 2 weeks ago)

What does this mean?

• Short term nothing changes. At least not in terms of immediately ending the shutdown or the Governors phased reopening plans.

A Wolf spokesperson stated: “this resolution does not affect the Secretary of Health’s order including business closure orders, building safety orders, and business safety orders, and therefore the Administration’s phased reopening plan and associated orders would remain in place even if it passes”

This shapes up a coming court battle. The Governor on one side and those who supported the resolution on the other are framing up their legal arguments on what this means since the Governor is not expected to sign a termination declaration. And it appears the whole thing will be sorted out by the courts which will take time.

Opponents to terminating the emergency declaration have expressed concern about losing federal aid. The problem with this is that the need for federal aid is because of a government imposed shutdown. End the shutdown and we will no longer need massive federal aid packages. This sort of becomes a chicken and the egg argument.

• From a local standpoint, I’ve written my thoughts on the continued shutdown and further Lower Macungie Commissioners unanimously approved and sent a resolution to the Governor asking him to “to accelerate the opening of Lehigh County businesses and industries, specifically business and industries in Lower Macungie Township, at the earliest possible date and in the most expeditious manner possible.” We were the first community to do so. At least one other has since done the same.

In Lower Macungie, sadly we’ve seen 34 deaths due to Covid-19 or Covid 19 RELATED issues (compounded with other issues). 32 of these have been in long care facilities with the average age being over 80. It’s very clear the highest risk has been and remains with one very specific segment of our community where yes, extreme caution is still warranted. This is a reason we spearheaded a volunteer effort over the last 4 weeks to get hand sanitizer into the hands of township senior citizens over the age of 80.

• Coequal branches of Government and seperation of powers. Beyond that, and just as important in my opinion this is a going to be a critical court decision on Constitutional balance of power and co-equal branches of Government. I’ve been writing for years on my blog about concerns in virtually all levels of government from Federal, to State to local County with erosion of constitutional checks and balances.

Executive overreach is a major problem and has eroded constitutional checks and balances. A future decision on this issue could go a long way to re-establishing co-equal branches in the state of PA.

When the dust settles and even earlier I hope to advocate for the proposed constitutional amendment that would require legislative assent to a disaster emergency declaration after 30 days. This would go a long way to restoring a constitutional check on futures issues like this.

Another COVID small business story.

On my Commissioner Facebook Page, last 2 weeks I’ve been sharing stories from small businesses owners trying to navigate the shutdown. In many cases highlighting failures and inadequacies of various state and federal small business stimulus programs from the perspectives of actual self employed folks. Especially the most vulnerable who seem to fall through policy cracks. In many cases, weeks after the shutdown started many small business owners have still not seen a penny of relief.

Here is the most recent story. This time, the business is not in Lower Mac but nearby in an adjacent community and Southwest planning partner. It describes in practice one of the fundamental problems with the PPP program. Has to do with the government inadvertently creating disincentives to work, paired with the fact one of the requirements for PPP loan forgiveness is to keep employees on payroll. (I’ve edited it down slightly, and removed identifiers)

“I tried to stay open for a couple weeks, but lost more money staying open for takeout than if I would have closed. Been closed for a month, employees are receiving unemployment + $600/week now. If an employee regularly makes $16/hour or $640 a week now that same employee is getting $1,000/week on PA unemployment.

The only way I can get some relief from the PPP is to put my employees back on payroll… so now, what should have been a good thing, has become a bad thing.

My best case scenario after going backwards $50k in the last 5 weeks, is to get rent and utilities paid for 2-months. I’m not looking for anyone to feel bad for me, but everything the gov’t does is backwards.

It should have either been PPP or juiced up Unemployment, not both. Or some type of means testing to give people more based on their income. There will absolutely have to be more money available. Going in this I was in a good financial situation, I would imagine other businesses are really in a bad place right now.”

Above is the most recent version of the same or similar story I’ve heard many times now. For an actual small business lucky enough to get a PPP loan it has caused a whole other set of challenges.

Yes, the extra unemployment boost was necessary, but the way the $2.2 trillion (about to be more) CARES Act was drafted, it encourages employees to stay home. But when they stay home, it puts small business owners in a bind since one criteria for getting PPP debt forgiven is to keep employees on payroll. An internal federal study estimates that this scenario applies to millions of Americans.

To be clear, can you blame employees? They are making rationale financial decisions based on realities created by the government. In this case creating a disincentive to work when another government program requires employers to keep people on payroll to get debt forgiven. These are folks in some cases without the luxury of planning too far into the future. Some are worried about how they are going to pay next months bills.

Pandemic blogging. . .

Today was the first day PA is requiring masks for all patrons of essential businesses. As some of you know, few weeks ago I picked up a part time job at a local supermarket. Did it for a number of reasons. First, with my business shut down I’m just not good at sitting around doing nothing and I wanted to feel like I was helping somehow. I work early mornings and stock shelves. I can tell you first hand, keeping a supermarket stocker during a pandemic is labor intensive. These folks are working their tails off. One longtime employee who works longer than I do put on 15 miles on a busy day last week. The particular supermarket I’m at operates lean and mean as a business model. So, the whole store is basically stocked by 4-8 people from 6am-9am each day before the doors open. The manager who is an old friend of mine is pulling 50+ hour weeks. He’s a taskmaster for sure! Runs a tight ship. Has to during this whole mess.

There have been lines each day at 9am when we open. A few times I’ve been assigned to be the “bouncer”. This means wiping down carts, helping to monitor capacity and making sure the crowds don’t jam up as shoppers flow through the store. I really enjoy striking up conversations with folks. I’m fine working with a crowd cause that’s basically what my regular job is. Generally, I’d say 99% of folks are extremely nice during this despite the crummy circumstances. The folks who aren’t represent a very small number. When I encounter them I try to remember this could be a stressful time for folks and you really never know what someone else is going through.

Today, I was outside for an hour when the store opened and during that time, there was only 1 person who didn’t have the now required mask. I explained to her the new state policy and so she improvised one from stuff she had in her car. Wasn’t an issue and she was really cool about it.

In hindsite with ongoing issues the small business components of the CARES act and state self employed UC are having, this job is a big help. So far it’s ensuring I do not have to dip into savings for day to day stuff and bills.

The fact so many of the most vulnerable small businesses are still seemingly slipping through the cracks is frustrating. As a self employed person I haven’t seen a single penny of relief yet in any fashion whatsoever whether it’s UC, grants, loans or direct stimulus. This stuff will come and be retroactive where it applies but it’s taking forever. Luckily, I got a grant from the private sector which will be helpful to pay the mortgage on our office.

While my family is in a good position all things considered with savings plus the temporary essential job, I know other small business owners who aren’t. The state and federal government have got to get it together for these folks soon or I personally know some that may not be able to open back up.

Stay safe everyone.

-Ron

Municipal Government & Emergency Declarations

Similar to the state and county, local governments (Townships, Cities & Boroughs) can also make emergency declarations. Locally, the paperwork has been prepared should this be needed. However, at this point Lower Mac has not declared an emergency declaration due to COVID-19. I don’t anticipate it happening at this point.

What does an emergency declaration do?

According to the Pennsylvania Emergency Management Agency here is what an emergency declaration does and doesn’t do.

·Funding: First, there is no need for a municipality to declare a local disaster emergency in order to access emergency funding. The state has already declared an emergency and will be eligible for its share of federal funding. That funding is sent in a block to the state to be distributed based on need. Declaring an emergency in your borough or township will not determine if your municipality receives funds or how much it may receive. To date, the township has not spent funds dealing with COVID-19. Even if we did, as stated above it’s not necessarily a pre-requisite to declare an emergency to get reimbursed by the federal or state government.

·Law Enforcement: Declaring a local disaster does not confer any additional powers to local law enforcement. Even so, Lower Mac gets police protection from the PA State Police.

·Facilitation of purchases / hiring temporary workers: However, declaring a local disaster may be of benefit to local governments in the following areas:

(c)Contracts & obligations.

An emergency declaration gives municipalities the power to enter into contracts and incur obligations necessary for disaster emergency management, response and recovery.

(d) Temporary suspension of formal requirements.

Municipalities declaring emergencies are authorized to exercise emergency powers without regard to time-consuming procedures and formalities prescribed by law (excepting mandatory constitutional requirements) pertaining to the performance of public work, entering into contracts, the incurring of obligations, the employment of temporary workers, the rental of equipment, the purchase of supplies and materials, the levying of taxes and the appropriation and expenditure of public funds.

(e) Employment of personnel.

Municipalities who have declared emergencies can get Federal contributions in connection with the employment of emergency related personnel.

Why Lower Mac has not declared an emergency:

Mainly because we have not had the need to expedite deployment of resources or decision making locally. Much of the needed rapid response to COVID-19 involves systems quarterbacked by State and (in some cases) County agencies. Also, as mentioned above much of the local provisions authorized by the state deal with having to enter into contracts or conduct other local government business in an expedited fashion.

Though COVID-19 is a very serious issue, the nature of the beast has not required that we do any of this. To contrast, a weather related emergency such as a hurricane could dictate the township deploy public works to do things like clear roads or make emergency repairs of infrastructure. There could be costs associated with these actions, so this would be an example of where a local disaster declaration would make sense.

Since by nature declaring a disaster in theory could open the door to reducing government transparency, taking these actions should be a measure of last resort.

What we’re doing locally in response to COVID-19 is making decisions about public facilities including closures, communicating that information to residents, protecting public employees in the workplace and amplifying state public health messages. We can do this at a high level with resources already in place.

*Note, thanks to Senator Pat Browne’s staff for excellent clarification on some of these points. They have been an important resource.

Reflect on current events with the wisdom of the past.

Hannah Arendt, in The Origins of Totalitarianism (1951), said the following factors in German and Russian society made them susceptible to parallel rises in Nazism (authoritarianism, ultranationalism) and Bolshevism (leftist socialism communism):

•Loneliness

•Loss of faith in hierarchies and institutions

•Indifference to truth, and the willingness to believe useful lies

•A mania for ideology

•Social atomization

•The desire to transgress and destroy

•A society that values loyalty more than expertise

•The politicization of EVERYTHING

Coincidently and perhaps timely, while cleaning out a closet in the basement I found my copy of OOT from school. Good time to re-read. Also coincidently and sadly, I saw Dr Rich Martin who taught political theory at SRU where we studied Arendt passed away last year. He taught his students to reflect on current events with the wisdom of the past.

Revisiting the 2020 visioning document. Part 2

Lower Macungie accomplished many of the goals laid out 11 years ago in the 2020 visioning statement. In 2009 Commissioners appointed 24 citizens to serve on a committee charged with preparing a statement to envision what Lower Macungie would be like in the year 2020. They worked in small groups to develop statements on; Quality of Life; Planning and Land Use; Parks and Recreation; Public Safety; and Community Government. So here we are, the year 2020. A logical time to look back at the 2020 document and see how we did. I started last week with part 1. Below is part 2.

Overview Part 2 – Informed, active & engaged citizens.

The 2020 visioning document stated: “Our government will utilize all reasonable methods available to achieve active, broad, inclusive citizen engagement in government to assure a government of, by and for all residents”

“The citizens will determine the powers and limits of their government which will be receptive to citizen concerns and maintain continuous contact with citizen groups to improve its transparency and its methods of responding to the needs of residents and businesses.”

Lower Macungie is among the leaders in community engagement. It starts with a commitment to transparency. All Commissioner meetings are taped and linked on the township website. All Commissioner meeting agendas are posted online a week before the scheduled date. This includes lengthy detail and all relevant supporting documents. We hold public comment at the beginning and end of each meeting in addition to opportunities for residents to weigh in on every action item.

You would think these practices are standard in local communities, but they aren’t. Many communities do not allow resident comments on agenda items, and some even bury public comment at the end of the meeting. For Lower Mac, public comment is built into the DNA of our meetings. The philosophy is also reflected in our committee system where conversations can happen in less formal settings than the townships formal business meetings. All committee meetings are advertised and open to the public.

We strive to keep residents informed through many avenues. Staff maintains a very active township Facebook and twitter page. We utilize an opt-in automated notification system. Phone, text, and email alerts are used to provide information on weather-related trash collection delays, leaf collection, and municipal closures as well as in the event of an emergency. We send quarterly newsletters via US mail to all households.

We seek resident input on all major initiatives. A recent example was the southwest regional comprehensive plan update. We employed a variety of methods to engage and solicit feedback across different constituencies. This included a special website, public engagement sessions, a survey that 1,333 residents participated in and public meetings. This same format was utilized for multiple projects over the last few years. The Kratzer Farm park planning and Greenway master plan as two examples.

An area we can improve is the township website. I believe it feels dated and could be improved to be more easily navigable and searchable. This is a conversation I hope to have this year.

On an individual note, I personally spearhead numerous initiatives geared to keeping residents informed. I maintain this blog primarily about Lower Macungie news, notes and issues with over 400 posts made last 6 years. I have my Commissioner Facebook page where I seek to engage and inform residents on an almost daily basis. I’ve held over a dozen town hall-style meetings throughout the township in numerous neighborhoods. Beginning last year I started co-hosting “Coffee with a Cop” events with the Pennsylvania State Police in an effort to help connect neighborhoods with the Troopers who serve and protect our community. Most recently, I conducted a broad-based community survey seeking resident input on a variety of topics including, crime and safety, land use, farmland preservation, the park system, taxes, and other areas. If you have not taken the survey yet you can do so here.

Revisiting the 2020 visioning document.

Lower Macungie has accomplished many of the goals laid out 11 years ago in the 2020 visioning statement.

In 2009 Commissioners appointed 24 citizens to serve on a committee charged with preparing a statement to envision what Lower Macungie would be like in the year 2020. The committee consulted with residents through a public meeting and a questionnaire. They worked in small groups to develop statements on; Quality of Life; Planning and Land Use; Parks and Recreation; Public Safety; and Community Government. The work produced an aspirational document that has been used by Commissioners and staff as a resource. So here we are, the year 2020. A logical time to look back at the 2020 document and see how we did. Over the next few days, I’m going to make a series of posts overviewing one section of the document at a time outlining what’s been accomplished and what we still need to work on relative to that area. I’m also sending these updates to the original committee members.

Section 1 – Quality of Life

The 2020 visioning document stated: “Citizens of Lower Macungie will enjoy outstanding quality of life in their community, especially: the educational system, our parks and recreation programs, and preserved farmland and open space. Citizens will be able to travel safely to facilities, activities, and events in the community through trails. bikeways, and greenways that connect neighborhoods, parks, commercial districts, and the Town Center. The community’s government and School District will collaborate and cooperate to ensure maximum use of local resources to benefit all citizens.”

This conversation begins with the successful farmland and open space preservation program. Over the last 5 years, Lower Macungie has permanently preserved well over 500-acres of farmland and open space through various strategies. This includes one of the biggest preservation efforts of it’s kind in Lehigh County history. The permanent preservation of the 190-acre Weiner Farm on Brookside and Sauerkraut Rd.

The following farms and open space properties are some of the highlights of what has been preserved over the last 10 years:

- Swallow Farm 22 acres Mountain Rd.

- Kirby Farm 66 acres Rt. 100

- Weiner Farm 190 acres Sauerkraut, Brookside & Macungie Rd.

- Krause Farm Mountain Rd.

- Dixon Farm 11 acres Spring Creek Rd.

- Smith Farm Mountain Rd.

- 70% public open space preserved in a 100-acre development project on Gehman Rd.

- Campbell Tract Purchase (addition to camp Olympic) 16-acres

- The Heim Farm 55 acres Mountain Rd.

Moving forward we continue to look for more opportunities to preserve farmland and open space. We should be finalizing the preservation of an additional 150-acre farm property in the next few weeks.

The quality of life section also envisioned a township greenway. Since 2009, a master plan was adopted in 2012 and the first major section of the planned greenway, a half-mile in total was completed between Wild Cherry Ln. and Brookside Rd. Completing the greenway will take many years. But we’ve got a great start with this section adding to pre-existing sections that pre-date the formal plan. A challenge is securing the funding to complete the project.

The first major section of the Lower Macungie Township Greenway to be constructed after adoption of the 2012 master plan is located between Brookside and Wild Cherry Rd.

The document envisioned a walkable and bikeable community. While work remains, great strides have been made. Bike lanes were installed on Sauerkraut Ln. and Hamilton Blvd. Numerous gaps in walking paths have been addressed and crosswalks installed at key locations. And with every development project of the last 10 years, a focus has been made to secure walkability in the land development process. The biggest example being the Hamilton Crossings project.

The section mentions the park system where numerous improvements have been built over the last ten years. I wanted to highlight in particular the work done at Camp Olympic which includes the installation of a disc golf course, new restrooms, (with alot of help from volunteers) a new pump park, eco playground, renovation of the barn into an event space and LMTHS history museum.

Refurbished barn at Camp Olympic. Available for event rentals and is the home of the LMTHS Bartholomew Center for Lower Macungie history.

Lastly, this section of the document envisioned the township working together with the East Penn School District. I’m happy to report that our staff meets regularly with key district staff. An example of collaboration is with the crossing guard program at Willow Lane elementary. Additionally, we continue to partner with the district on addressing sports field issues where township and district interests intersect.

I hope you find this useful. In a few days, I’ll overview section 2. Planning and Land Use. Thank you to Commissioner Brian Higgins who reminded Commissioners in January of this milestone. For each of these sections, I could probably highlight more but to keep these relatively short I’m limiting to the major highlights.

If there is any area you’d like to discuss in greater detail please don’t hesitate to reach out. Let me know if you have any questions,

Ron

Ronbeitler@gmail.com

P.S. On a sad note, as most know a few members of the 2009 committee have passed away. With that we take a moment to remember, Dennis Timmer, Bill Hansell and Bill Spaide.

In year end report Chief Justice Roberts speaks to dangers of fake news.

Chief Justice of the Supreme Court John Roberts in his 2019 year end report spoke about the dangers of fake news and the need for more civics education. He utilized the story of how the Federalist papers, America’s greatest civics lesson was written by Alexander Hamilton, John Jay and James Madison. Jay contributed the least work in large part because of an injury he suffered quelling a public disturbance based on a fake rumor.

Fake news always existed, but with the advent of the internet the ability for it to spread unchecked has been supercharged. This is one of the biggest challenges we face as a society in 2020.

“In our age, when social media can instantly spread rumor and false information on a grand scale, the public’s need to understand our government, and the protections it provides, is ever more vital.”

He went on to talk about ways “judges and staff of federal courts are taking up the challenge” including courthouses hosting learning centers.

Locally, I’m happy to hear the East Penn School District is tackling this subject. Teachers are including lessons showing students how to independently analyze news reports for bias and to fact-check stories.