IMPORTANT TAX BILL INFO:

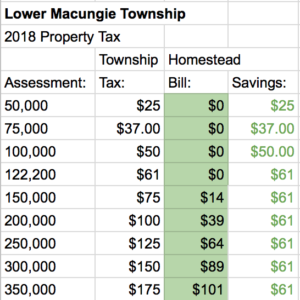

Lower Macungie Homeowners – Are you enrolled in Homestead? It’s a program the board enacted to further reduce your property taxes. The chart below shows your savings. The green column is the amount of your bill after homestead savings.

(*Note, school property tax bills are separate and set by the School Board)

Morning Call: Lower Mac Commissioners give homeowners tax break

Recently, Homestead and Farmstead exclusion applications have been mailed out to eligible households by Lehigh County who are NOT already enrolled.

Once again, the township has set the homestead rate to the maximum allowed by the state. Eligible homeowners deduct the median home value from the assessment used to calculate their property tax bill.

This year that increased to 121,200 since home values increased in the township. This means 1,329 Lower Mac homes assessed under that amount are eligible for full relief. All others get a reduced bill. The chart below shows your savings. Lower Mac has the lowest Township property tax of any suburban Lehigh County community.

Properties eligible for exclusion include primary owner occupied homes. To receive the discount you must be enrolled. Applications are due March 1st. You can check your enrollment status by calling the County at 610.782.3038.

Information on if your home qualifies here.

Chart above shows your homestead savings. The Green column is your bill after homestead.

Interested in the 2018 township budget? Click here:

The adopted 2018 budget – A snapshot.